Considerations To Know About Colorado Springs Mortgage

Colorado Springs is usually a lively and rising city, attracting people and family members who wish to settle down and produce a steady existence for them selves. Among the most important elements of achieving that steadiness is proudly owning a home. For most, this necessitates securing funding to invest in a residence. The process of obtaining household funding is often advanced, but comprehending the intricacies and options out there might make it far more workable. Whether you are a first-time purchaser or a person aiming to refinance, exploring several dwelling mortgage options is important to obtaining the most effective in shape for your preferences.

The housing market place in Colorado Springs has seasoned continuous expansion, with home prices reflecting the region's desirability. Components like affordability, proximity to nature, and a powerful nearby economy ensure it is a beautiful desired destination for homebuyers. Using these variables in mind, individuals frequently seek economic alternatives to bridge the hole in between their savings and the cost of their dream property. The supply of house loans in the region ensures that prospective prospective buyers have access to the assets required to make their homeownership aspirations a actuality.

For anyone considering purchasing a residence in Colorado Springs, it’s crucial to be aware of the basics from the mortgage loan system. A mortgage loan is essentially a loan that allows you to buy house without the need of paying out the full value upfront. The lender provides the resources essential to invest in the home, and you repay the mortgage with time, typically in every month installments. These installments contain both equally the principal sum plus the interest accrued about the personal loan. Interest prices Perform a major role in pinpointing the general expense of a loan, rendering it critical for borrowers to protected favorable terms.

Differing types of property loans cater to numerous fiscal scenarios. Fixed-price loans are well-liked as they supply predictable payments around the lifetime of the loan, ordinarily 15 to 30 decades. Adjustable-fee loans, However, have desire charges that could fluctuate with time dependant on market place problems. Borrowers will have to thoroughly assess their monetary steadiness and potential programs when choosing between these choices. For some, the predictability of fastened costs is an improved fit, while some may possibly take pleasure in the Original decreased payments of adjustable-fee financial loans.

Another critical Consider obtaining a home loan is your credit rating rating. This range serves like a evaluate of one's money responsibility and implies to lenders how very likely you might be to repay the personal loan. A higher credit rating rating usually translates to raised desire rates and mortgage phrases, even though a lower score might cause larger fees or problem securing funding. Prospective borrowers must Check out their credit rating reviews and address any inaccuracies or issues prior to applying for a bank loan. Getting techniques to transform your credit score score can make a substantial distinction during the property finance loan choices accessible to you.

The sum of money you are able to borrow also depends on variables like your income, present debts, and the sort of property you’re paying for. Lenders ordinarily calculate your debt-to-earnings ratio to determine just how much you'll be able to afford to pay for to borrow. This ratio compares your month-to-month financial debt payments in your regular monthly cash flow and delivers insight into your monetary potential. Keeping this ratio low is useful when applying to get a loan, since it demonstrates which you can comfortably manage more debt.

Down payments are another vital aspect of securing a bank loan. This upfront payment is really a proportion of the home’s order price tag and serves as a sign of one's motivation to the financial commitment. While common financial loans often require a 20% deposit, you will discover selections accessible for individuals who can not afford to pay for this sort of a sizable sum. Some financial loan systems cater to to start with-time customers or men and women with lessen incomes, featuring minimized down payment necessities. Discovering these selections might help make homeownership more available into a wider selection of people.

On top of that to traditional loans, federal government-backed plans can offer further aid for homebuyers. These involve solutions like FHA loans, that happen to be insured via the Federal Housing Administration and intended to support those with constrained savings or decrease credit score 104 S Cascade Ave #201 Colorado Springs CO 80903 scores. VA financial loans, offered with the Division of Veterans Affairs, are available to qualified navy personnel, veterans, and their family members. These financial loans usually aspect favorable phrases, for example no down payment prerequisites and competitive desire prices. USDA loans are an alternative choice, catering to potential buyers in rural and suburban parts who meet unique cash flow requirements.

Refinancing is another avenue that homeowners in Colorado Springs could consider to make improvements to their financial problem. Refinancing requires changing your existing bank loan which has a new just one, frequently with superior phrases. This will aid lower month-to-month payments, decrease interest rates, or shorten the financial loan term. For a few, refinancing is actually a strategic move to consolidate personal debt or entry equity within their home. Nonetheless, it’s important to weigh The prices of refinancing, such as closing fees, against the possible financial savings to ascertain if it’s the best alternative.

As housing costs fluctuate, market place conditions could also influence The provision and conditions of residence loans. Desire fees are influenced by components such as the federal money fee, inflation, and economic expansion. Being knowledgeable about these tendencies might help borrowers make your mind up when to make an application for a financial loan or refinance their existing a person. Working with a experienced lender or economical advisor can also supply important insights into timing and system.

For initial-time consumers in Colorado Springs, navigating the house financial loan approach can come to feel overpowering. However, finding the time to teach by yourself about the choices and needs can empower you to produce educated decisions. Understanding your finances, looking into financial loan programs, and planning your finances are vital actions while in the journey towards homeownership. Additionally, trying to get pre-acceptance from the lender can present you with a clearer photo of the amount you could afford to pay for and improve your position when building features on Homes.

Closing fees are An additional thing to consider when paying for a house. These expenditures, which contain service fees for appraisals, inspections, and title expert services, can include up promptly. Prospective buyers should issue these expenditures into their budget to stay away from surprises during the home-buying process. Sometimes, sellers could conform to address a percentage of the closing expenses as Section of the negotiation. Discovering all avenues to attenuate these bills can help you far better regulate your finances.

The journey to possessing a home in Colorado Springs is certainly an interesting a single, but it surely calls for cautious preparing and thought. From knowing bank loan styles to making ready for closing charges, Every phase performs an important role in attaining your homeownership goals. By arming on your own with awareness and working with trusted specialists, you can navigate the method with self confidence and protected the monetary assist required to make your dream dwelling a actuality. Whether or not you’re shopping for your initial residence, upgrading to a bigger space, or refinancing to higher accommodate your needs, the alternatives for success in Colorado Springs are abundant.

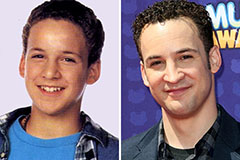

Ben Savage Then & Now!

Ben Savage Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!